Statement by Prof. Jose Maria Sison

NDFP Chief Politicfal Consultant

November 4, 2018

Duterte and his cronies are so greedy and eager to collect privately hundreds of millions of dollars as finder’s fees for brokering the billions of dollars of loans from China for overpriced infrastructure projects.

They are acting as swindlers and thieves. Until signing time, they are deliberately concealing from the Filipino people the terms of the framework agreement and the loan agreements which are expected to turn the Philippines into a debt colony of China.

They use the natural resources of the Philippines as collateral for unrepayable loans and violating the sovereign rights of the Philippines of the Filipino people over oil, gas and other natural resources under the West Philippine Sea.

The trillions of dollars worth of Philippine oil and gas are being given away for a few billion dollars worth of high-interest Chinese loans for overpriced infrastructure projects done mostly by Chinese workers. Traitorous and stupid!

The debts from China come on top of the already huge accumulated debt from the US, Japan and other traditional lenders. With the US Federal Bank raising interest rates on the US dollar under a new policy of quantitative tightening, the previously accumulated debt of the Philippines will automatically grow.

The Philippines is already suffering from a debt crisis. The Duterte regime, especially its chieftain Duterte, will go down in history as a traitor to national sovereignty and to the people’s interest in self-reliant development through national industrialization and land reform and wise utilization of the rich natural resources of the Philippines.###

==================================================================================

Is the Philippines heading into a debt crisis?

August 17, 2017

With limited public information over proposed Chinese loans, Duterte may be leading a blindfolded public straight into an economic crisis.

By Oliver Ward

‘Build, build, build’ has been the cry from the Duterte administration in the Philippines, as the President plans to plug infrastructure gaps to drive economic growth. With Duterte’s prior approval for 21 new infrastructure projects worth a combined US$16 billion, budget secretary Benjamin E. Diokno outlined plans to spend 5.2% of Philippine’s Gross Domestic Product (GDP) on infrastructure in an effort to usher in a “golden age of infrastructure”.

But the golden age comes at a cost, US$167 billion, according to Diokno himself. With such a high initial outlay, the Philippines is looking for a potential lender to fund their ‘build, build, build’ mantra. This lender has proven to be the Chinese. From Malaysia to Myanmar, the Chinese have been bankrolling national projects across Southeast Asia – the Philippines’ is no exception. But, with minimal information available to the public and Congress of what the loan conditions might be, there are serious concerns that Duterte is taking the Philippines head-first into a debt crisis.

Chinese loans will fund key Filipino infrastructure projects

In the last 12 months, Beijing has entered discussions to provide funding for two Philippine railway projects with a combined cost of US$8.3 billion. They have also discussed the possibility of helping fund up to 30 smaller projects with a combined value of US$3.7 billion.

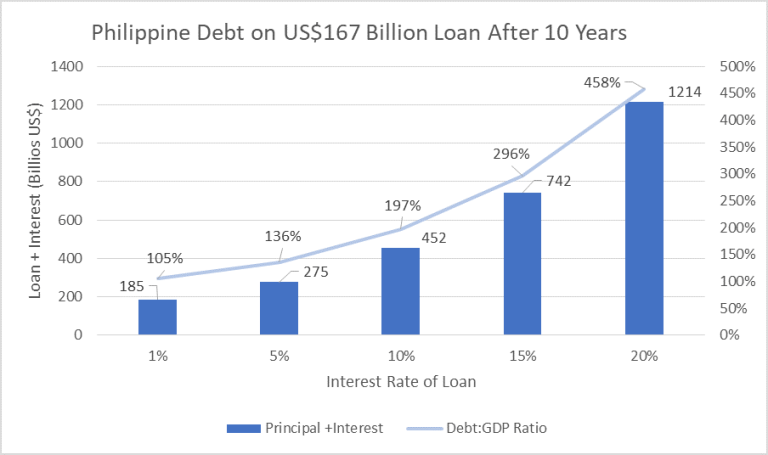

While the Duterte administration has been transparent about courting Chinese loans and investment, it has been less forthcoming about the conditions and potential implications of these loans. If China imposes high rates of interest on their loans, Filipino debt could severely swell in a decade. For example, if Diokno’s estimation of US$167 billion is sourced from China at a rate of 10% interest, in ten years the Philippine debt to GDP ratio would soar to 197%, which would give them the second worst debt: GDP ratio in the world.

Even under a fairly favourable interest rate like 5%, which is the World Bank’s recommended rate of interest for the Philippines, the debt would increase to US$275 billion after ten years. This would be a sizeable debt and push the Philippines debt to GDP ratio up to 136%. (See Graph)

However, it is unlikely that the Philippines would be able to even secure such a favourable rate on such a large amount of money. It is more likely that the interest rate for such a large loan would be established somewhere between 6 and 14% – but that leaves a huge margin for how entwined the Philippines could end up in a debt bondage to China.

Without releasing all the details of the loans to the Philippine Congress and the general public, it becomes impossible for Congress to conduct a full cost-benefit investigation and vote for the loan to proceed. Without greater transparency and careful cost-benefit analysis, the Duterte administration may condemn the Philippines to unsustainable levels of national debt, put the Philippines in a situation where they are tied to China in a bondage of debt and open the country up to all the pitfalls that come with it.

Duterte’s building and borrowing strategy has already negatively impacted the economy

With so many local builders importing capital goods and funding the purchases with loans, the Philippines current account has deteriorated from running at a surplus to operating at a deficit. Imports of capital goods in the first five months of 2017 have increased by 7% from the same period last year. This has caused the Philippine current account deficit to plummet to 15-year lows of US$600 million.

In July, the Philippine Peso reached an 11-year low against the dollar. This also comes at a time when the Thai Baht and Malaysian Ringgit are enjoying multi-year highs.

Joey Cuyegkeng, a senior economist at ING, expressed his concerns about the impact this would have on foreign investment. “Until investors feel the imports work through the economy and push it to a higher growth path, the market’s focus would be on a deterioration in the balance of trade”, he added, “we expect a gradual Peso weakening”.

Several public ministers have expressed their concerns

The loans have not gone unnoticed by the Philippines government, and some members increasingly concerned. In May, Senate President Pro-Tempore Ralph Recto warned President Rodrigo Duterte publicly about the dangers of using Chinese loans to fund a plan to modernise the Filipino Armed Forces.

Georgina Hernandez, spokeswoman for the separately elected Filipino Vice President Leni Robredo also conveyed his concerns over the conditions of the loan plan to drive infrastructure development. She told the media, “we want to know if these infrastructure projects that will be funded by loans from China will really translate into actual jobs for skilled and unskilled labourers”.

Will it be a Chinese loan for Chinese labour?

Hernandez’s comment brings up a pertinent question – Who will benefit from the arrangement? China’s loan agreements to other regions, particularly on the African continent, but also across Southeast Asia, have involved the use of Chinese labour. If the infrastructure projects do not translate into jobs for Filipino workers and are not sourced from Filipino made parts and materials where possible, the benefits of the projects will be severely mitigated.

Diokno attempted to ease concerns over the use of Chinese labour. He pledged that any borrowing would favour an 80-20 scheme working in favour of local sources. He added that his “borrowing mix of 80-20 will minimise foreign exchange risk”.

This is another reason why greater transparency over any loan conditions is needed. The Duterte administration must be held to account over the terms they accept, and any failure to negotiate protection for the use of local labour and materials will need to be fully investigated and disclosed.

Such large loans leave the Philippines vulnerable to Chinese geopolitical interests

Entering into a debt bondage with China for such a large sum, no matter what the interest rates or labour and source conditions are, is a risky move for the Philippines at this time. With such severe financial leverage over the Philippines, China could use it to its advantage to strengthen its situation over claims in the South China Sea. The loan could be utilised as a valuable weapon to erode Filipino sovereignty and the conditions of the loan used as a useful negotiating weapon to further Chinese territorial interests in the region.

However, Duterte himself and his officials stand to benefit from the loans

Duterte himself and his government will personally receive hundreds of millions of dollars in finder’s fees for brokering the loans between the two countries. This would be paid for by the Filipino taxpayer.

For this reason, it becomes all the more necessary to allow the decision to borrow money from the Chinese to be voted on in Congress. There also needs to be full disclosure of the loan conditions so an independent authority can conduct a thorough cost vs. benefit analysis. With such a vested financial interest personally in the negotiations, it would be a gross injustice to the Filipino taxpayers to have this negotiation take place behind closed doors by a select group of Duterte’s allies.

A debt crisis of Duterte’s making could be looming, but Duterte has his heart set on keeping the public in the dark. It is up to Congress and the people to put pressure on Duterte to shine a light on proceedings and open the loans up to sensible and informed governmental debate. A failure to do so will burden the Philippines with a heavy debt bondage to China and undo much of the benefits Duterte’s build strategy aims to create.